In Government Gazette No. 49399 published on 2 October 2023, the Minister of Trade, Industry and Competition directed the International Trade Administration Commission of South Africa in terms of section 16(1)(d)(ii) of the International Trade Administration Act, Act 71 of 2002 (“ITA Act”), to consider the creation of a temporary rebate provision on meat and edible offal, fresh, chilled or frozen of fowls of the species Gallus Domesticus classifiable under HS0207.1.

The directive followed the Department of Agriculture, Land Reform and Rural Development (“DALRRD”) confirming the outbreak of Highly Pathogenic Avian Influenza (“HPAI”), which forced the culling of millions of fowls at great lost to key players across the poultry value chain.

During its investigation, the Commission considered the information at its disposal including comments received from interested parties, to arrive at its recommendation.

The Commission found that, inter alia:

• There is an expected shortage of poultry products in 2023 as a result of HPAI. However, this shortage could be addressed without necessitating the implementation of a temporary rebate by utilizing domestic producers’ existing inventory stock. The balance could be addressed by imports.

• To determine the estimated shortage of poultry products for 2024, the Commission used a structured methodology, encompassing a comprehensive approach to forecast broiler production figures. Consequently, the Commission estimated a possible shortage of approximately 172,000 tons for the year 2024.

• Information at the Commission’s disposal indicated that an acceptable balance could be found in implementing a Tariff Rate Quota (“TRQ”) system.

• It was also determined that the issuance of permits in terms of the rebate provision, could be discontinued at any time through a publication in the Government Gazette, contingent upon an assessment by DALRRD in consultation with the National Agricultural Marketing Council (“NAMC”) of the performance of domestic producers' production and their recovery from the HPAI outbreak.

Considering the foregoing, the Commission decided to recommend, inter alia, the following:

The creation of Schedule 4 rebate provision for poultry products classifiable under tariff subheading 0207.1, administered by ITAC, in the form of a ‘tariff-rate quota’ (TRQ). The rebate will be listed under Schedule 4 but will only be accessible for use in instances where the Director General of the DALRRD, reports an outbreak of HPAI in South Africa, giving rise to a shortage of poultry products as a result of the outbreak.

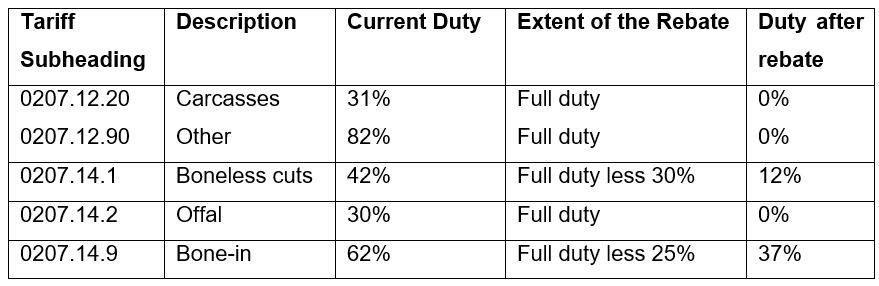

Poultry products classifiable under tariff subheadings 0207.14.1 and 0207.14.9 should be rebated to 2019 ordinary customs duty levels and all other poultry products classifiable under tariff subheading 0207.1 should be rebated to free of duty for low income consumers, as summarized in the table below:

Guidelines, rules, conditions and application forms are available on www.itac.org.za: https://www.itac.org.za/pages/services/tariff-investigations/guidelines-questionnaires

For any queries contact Mr Scelo Mshengu at smshengu@itac.org.za / Mr Joseph Mawasha at jmawasha@itac.org.za / Ms Elizabeth Kekana at ekekana@itac.org.za / Ms Dolly Ngobeni: dngobeni@itac.org.za / Amina Varachia at avarachia@itac.org.za

Full details of the report can be accessed here: ITAC Report No. 726

ISSUED BY THE INTERNATIONAL TRADE ADMINISTRATION COMMISSION OF SOUTH AFRICA